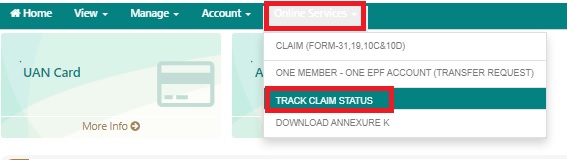

What Does Property Owners Insurance Policy Cover? A Full Guide If the rainfall damage is your mistake, state you left a home window open, or was brought on by an issue you found out about and fell short to fix, your property owners insurance policy would not cover you. Insurance coverage insurance adjusters might unjustly utilize exemptions or restrictions in your policy to lower the money the firm has to pay you or refuse to pay for your residential property repair work and replace your ruined contents. If you believe your claim was rejected inappropriately, working with a Michigan home insurance coverage asserts attorney may be a good alternative. Bear in mind that flooding and sewage system back-up damage normally call for added insurance coverage. If your home is harmed as an outcome of a flooding or sewer major backup and you do not have protection in position, you could be stuck spending for repair work expense. While home owners insurance policy offers crucial protection for threats like fire, theft, and wind damage, it does not cover flood damage. If you desire full protection for your home, particularly in the face of rising flooding threats, a separate flood insurance coverage is necessary. The short response is no-- conventional home owners insurance does not cover flooding damages. While your plan may secure you versus numerous threats, such as fire, wind, hail, and burglary, it normally omits water damages caused by flooding. If an evening of hefty rain causes your cellar to flooding, the water damages would certainly not be covered. It can be testing to recognize house owner's insurance coverage for water damage. As a matter of fact, the normal homeowner's policy just covers water damages under very minimal circumstances. You might need added coverage if you live in an area frequently impacted by floods or tornado rises. As a result, if among these water or moisture issues causes mold, it would probably not be covered by your plan. Flooding is the most regular and expensive catastrophe in the U.S. with ordinary flooding insurance coverage case payments that can surpass $100,000 depending on the calamity.

McAllen Storm Damage Lawyer

Just How To Stop Water Damage

Why is flooding insurance coverage not consisted of in a conventional homeowners insurance coverage?

The major reason flood insurance is not included in standard home insurance policy is the basically different risk evaluation. Flooding is a local event that can trigger considerable damages to homes in certain locations while saving others.

Can I Get A Discount On My Flooding Insurance Policy Costs?

- If you lug thorough coverage on your car policy, after that you would certainly have coverage for damage brought on by a flooding.If the rain damage is your fault, state you left a home window open, or was caused by an issue you learnt about and stopped working to fix, your home owners insurance policy would not cover you.The Colorado Water Conservation Board objective is to conserve, establish, shield and take care of Colorado's water for present and future generations.